Estate Planning Attorney - Questions

Table of Contents8 Easy Facts About Estate Planning Attorney ExplainedSome Of Estate Planning AttorneyAll about Estate Planning Attorney8 Simple Techniques For Estate Planning Attorney

Estate preparation is an activity strategy you can use to identify what takes place to your properties and obligations while you're to life and after you pass away. A will, on the various other hand, is a lawful document that details just how properties are dispersed, that deals with children and family pets, and any kind of various other desires after you pass away.

Cases that are denied by the executor can be taken to court where a probate court will have the last say as to whether or not the case is valid.

The Single Strategy To Use For Estate Planning Attorney

After the stock of the estate has actually been taken, the worth of assets computed, and tax obligations and financial debt paid off, the executor will then look for consent from the court to disperse whatever is left of the estate to the recipients. Any inheritance tax that are pending will come due within nine months of the day of fatality.

Each specific areas their properties in the trust and names someone other than their spouse as the beneficiary., to support grandchildrens' education.

Not known Factual Statements About Estate Planning Attorney

This method includes freezing the value of an asset at its click here for more info worth on the date of transfer. As necessary, the amount of possible capital gain at click for more fatality is also iced up, permitting the estate coordinator to approximate their prospective tax obligation obligation upon death and much better strategy for the repayment of income taxes.

If enough insurance coverage profits are available and the plans are effectively structured, any type of revenue tax on the considered personalities of assets adhering to the death of an individual can be paid without turning to the sale of properties. Proceeds from life insurance policy that are obtained by the beneficiaries upon the death of the guaranteed are generally earnings tax-free.

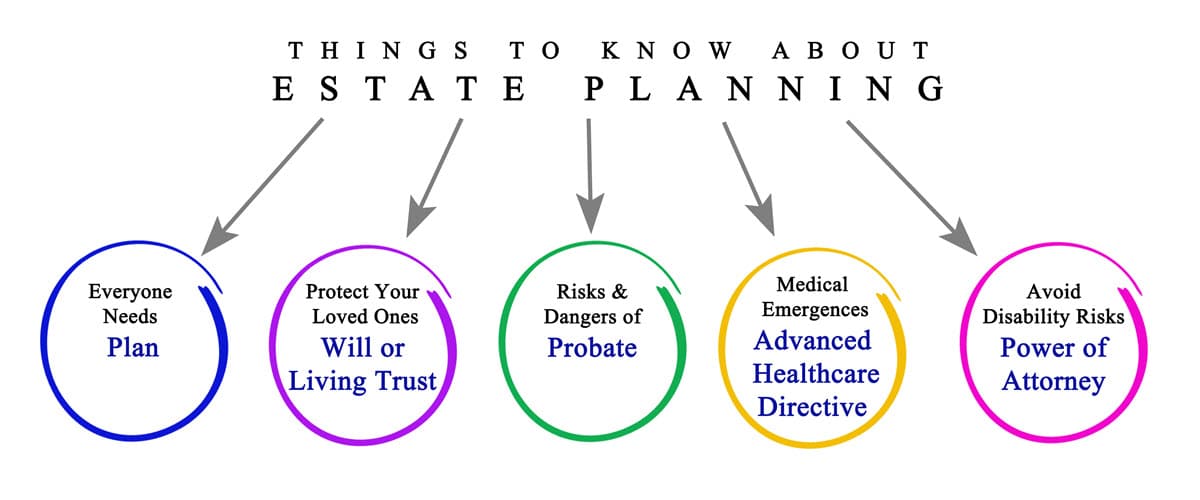

There are specific records you'll require as component of the estate preparation procedure. Some of the most usual ones consist of wills, powers of lawyer (POAs), guardianship classifications, and living why not find out more wills.

There is a misconception that estate preparation is just for high-net-worth people. That's not real. Estate preparation is a device that every person can make use of. Estate intending makes it less complicated for people to establish their dreams prior to and after they pass away. As opposed to what most individuals believe, it extends beyond what to do with assets and liabilities.

Estate Planning Attorney Things To Know Before You Buy

You should begin preparing for your estate as soon as you have any kind of quantifiable asset base. It's a recurring process: as life proceeds, your estate strategy must shift to match your scenarios, in line with your new goals.

Estate planning is frequently believed of as a device for the well-off. Estate planning is also an excellent means for you to lay out plans for the care of your minor children and family pets and to describe your dreams for your funeral service and favored charities.

Qualified applicants that pass the test will be formally certified in August. If you're qualified to sit for the examination from a previous application, you may submit the short application.